Jan Veld & Martin Larch & Marieke Vandeweyer, 2013." Great Recession and Fiscal Squeeze at U.S. " Theoretical Considerations Regarding The Automatic Fiscal Stabilizers Operating Mechanism,"Īnnals of Faculty of Economics, University of Oradea, Faculty of Economics, vol. repec:zbw:bofrdp:2020_013 is not listed on IDEAS.Review of Economics & Finance, Better Advances Press, Canada, vol. " Measuring the Effects of Monetary and Fiscal Policy Changes on the U.S. Inman, 2014.ġ4-20, Federal Reserve Bank of Philadelphia. " Macro Fiscal Policy in Economic Unions: States as Agents,"ġ9559, National Bureau of Economic Research, Inc. " Macro fiscal policy in economic unions: states as agents,"ġ3-40, Federal Reserve Bank of Philadelphia. " Are fiscal multipliers estimated with proxy-SVARs robust?,"īank of Finland Research Discussion PapersĢ020-69, Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University. Angelini, Giovanni & Caggiano, Giovanni & Castelnuovo, Efrem & Fanelli, Luca, 2020.Giovanni Angelini & Giovanni Caggiano & Efrem Castelnuovo & Luca Fanelli, 2021.Ģ021-08, Monash University, Department of Economics.Wp1151, Dipartimento Scienze Economiche, Universita' di Bologna. " Are Fiscal Multipliers Estimated with Proxy-SVARs Robust?,"Ġ257, Dipartimento di Scienze Economiche "Marco Fanno". Giovanni Angelini & Giovanni Caggiano & Efrem Castelnuovo & Luca Fanelli, 2020." Temporary Investment Tax Incentives: Theory with Evidence from Bonus Depreciation,"Īmerican Economic Review, American Economic Association, vol.

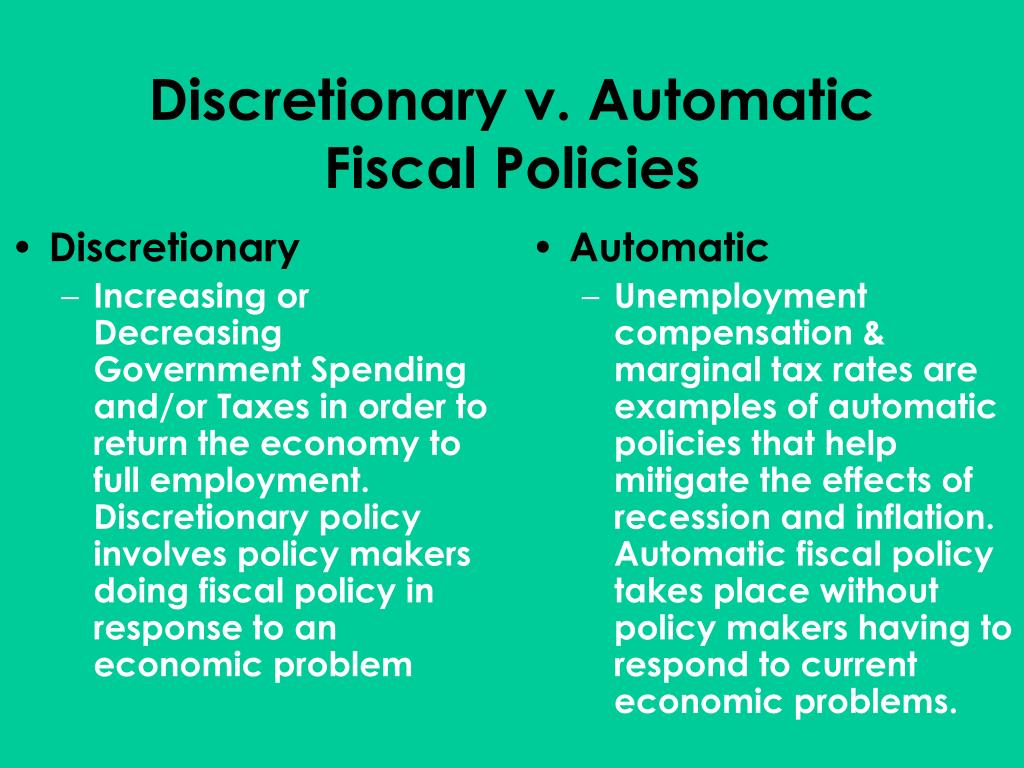

" The household spending response to the 2003 tax cut: evidence from survey data,"Ģ005-32, Board of Governors of the Federal Reserve System (U.S.). " Endogenous Federal Grants and Crowd-out of State Government Spending: Theory and Evidence from the Federal Highway Aid Program,"Īmerican Economic Review, American Economic Association, vol. The Review of Economics and Statistics, MIT Press, vol. " Taxation with Representation: Intergovernmental Grants in a Plebiscite Democracy," " What Causes Public Assistance Caseloads to Grow?,"Ħ343, National Bureau of Economic Research, Inc.ġ8, Northwestern University/University of Chicago Joint Center for Poverty Research. Finally, we evaluate the impact of the budget, from both automatic stabilizers and discretionary actions, on economic activity in 20.

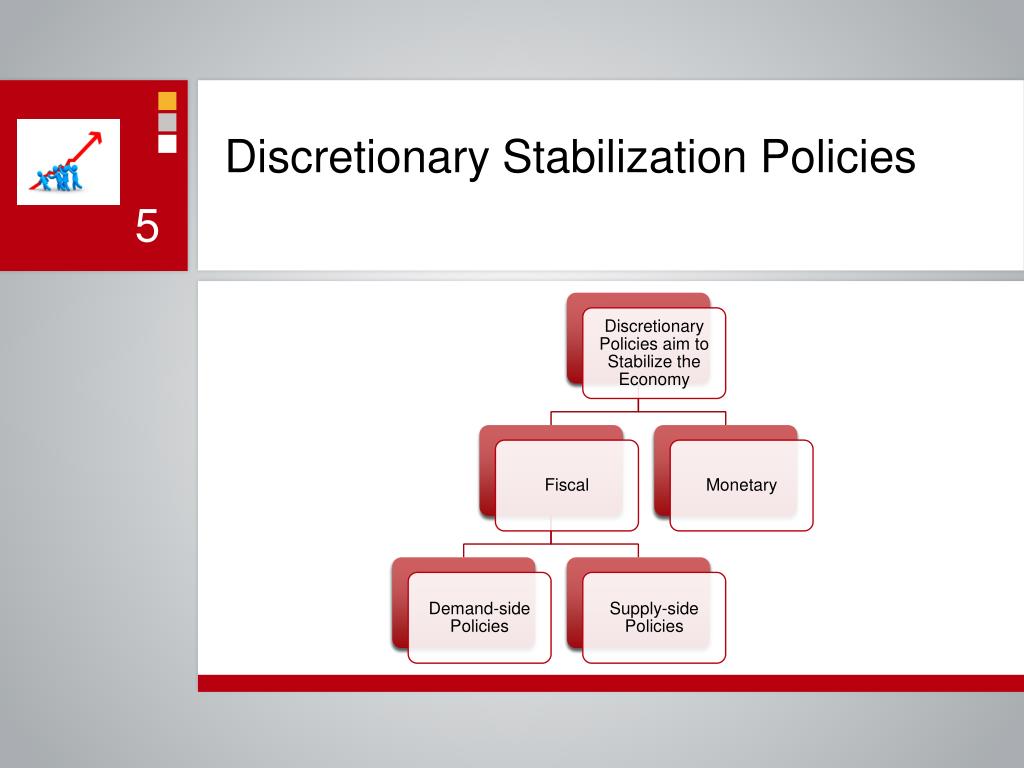

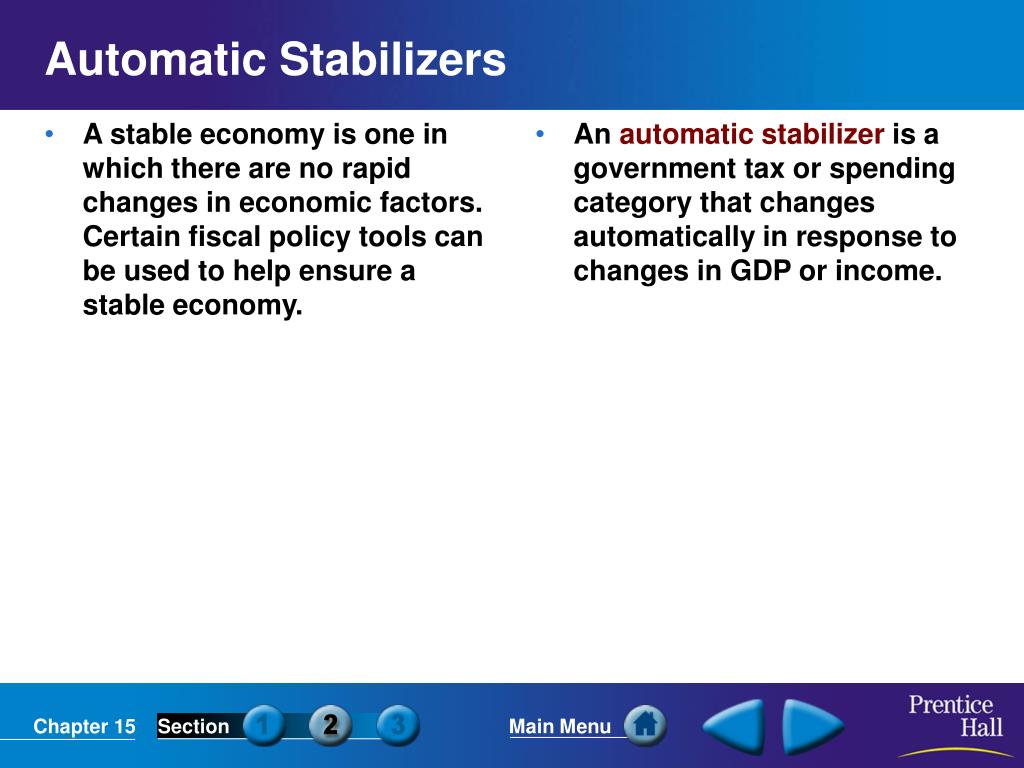

We find that federal policy actions are somewhat counter-cyclical while state and local policy actions have been somewhat pro-cyclical. Second, we provide measures of discretionary fiscal policy actions at the federal and state and local levels. We then examine the response of the economy to the automatic stabilizers using the FRB/US model by comparing the response to aggregate demand shocks under two scenarios: with the automatic stabilizers in place and without the automatic stabilizers. For state and local governments, the deficit increases by about 0.1 percent of GDP. For the federal government, the deficit increases about 0.35 percent of GDP for each 1 percentage point deviation of actual GDP relative to potential GDP.

First, we provide measures of the effects of automatic stabilizers on budget outcomes at the federal and state and local levels. We examine the effects of the economy on the government budget as well as the effects of the budget on the economy.

0 kommentar(er)

0 kommentar(er)